Tata Capital Ltd IPO — In-Depth Report & Market Update

1. Company at a Glance

Tata Capital Limited (TCL), the flagship financial services arm of the Tata Group, stands as one of India’s leading diversified non-banking financial companies (NBFCs). It offers a full spectrum of products — from consumer and SME finance to corporate lending, infrastructure funding, wealth management, and investment banking.

The company’s upcoming public issue represents a significant regulatory and strategic milestone, as the Reserve Bank of India (RBI) has mandated the listing of large “upper-layer” NBFCs. Tata Capital’s IPO is both a compliance step and an opportunity to strengthen its balance sheet, brand visibility, and retail investor participation.

2. Latest Market Updates (as of October 2025)

3. IPO Structure & Key Terms

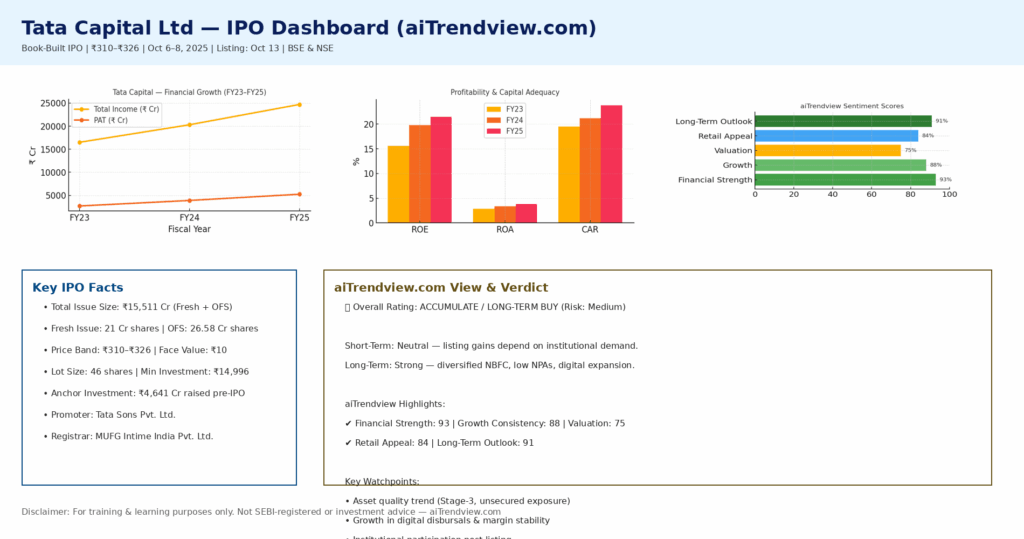

| Parameter | Details |

| Total Issue Size | ~₹15,511 crore |

| Fresh Issue | Up to 21 crore equity shares |

| Offer for Sale (OFS) | Up to 26.58 crore shares (Tata Sons, IFC, and others) |

| Face Value | ₹10 per share |

| Price Band | ₹310 – ₹326 per share |

| Lot Size | 46 shares (min investment ₹14,996) |

| Anchor Bidding | October 3, 2025 |

| Public Bidding | October 6 – 8, 2025 |

| Allotment | October 9, 2025 |

| Refunds / Demat Credit | October 10, 2025 |

| Listing Date | October 13, 2025 |

| Promoter | Tata Sons Pvt. Ltd. |

| Post IPO Promoter Holding | Likely to dilute from 95.8% |

| Registrar | MUFG Intime India Pvt. Ltd. |

4. Financial & Operational Highlights

| Metric | FY23 | FY24 | FY25 |

| Total Income (₹ Cr) | 16,500 | 20,300 | 24,700 |

| Profit After Tax (₹ Cr) | 2,700 | 3,900 | 5,250 |

| ROE (%) | 15.6 | 19.8 | 21.5 |

| Gross NPA (%) | 2.03 | 1.82 | 1.57 |

| Net NPA (%) | 0.57 | 0.46 | 0.39 |

| Capital Adequacy Ratio (%) | 19.5 | 21.2 | 23.8 |

✅ Strong financial trajectory: 3-year CAGR of ~21% in revenue and ~40% in PAT.

✅ Improving asset quality: Declining NPAs and steady risk-weighted exposure.

✅ Capital buffers strengthened: CAR comfortably above RBI thresholds.

5. Competitive Strengths

6. Key Risks & Challenges

⚠️ Unsecured Lending Risk: Growing share of unsecured loans (personal, micro, education) can raise credit costs in downturns.

⚠️ Valuation Sensitivity: IPO pricing below unlisted market rates may cause discontent among pre-IPO investors.

⚠️ Interest Rate Volatility: Margin pressure possible in a high-rate environment.

⚠️ Competition: Banks and fintechs intensifying pricing and distribution challenges.

⚠️ Market Sentiment Risk: Weak secondary market or geopolitical shocks may impact listing-day sentiment.

7. Valuation Overview

8. Investor Strategy & Insights

9. aiTrendview Sentiment Meter

| Factor | Sentiment | Score |

| Financial Strength | Strong | 93 / 100 |

| Growth Consistency | Robust | 88 / 100 |

| Valuation Comfort | Moderate | 75 / 100 |

| Retail Appeal | High | 84 / 100 |

| Long-Term Outlook | Positive | 91 / 100 |

10. aiTrendview.com View

Overall Rating: ⭐ Accumulate / Long-Term Buy (Risk: Medium)

Editorial Summary:

Tata Capital is a high-quality, systemically important NBFC with consistent profitability, strong capital adequacy, and trusted governance. Supported by Tata Sons’ backing and diversified lending, it offers long-term stability over speculative listing gains.

Why aiTrendview.com Likes It

Allocation Guidance

Post-Listing Triggers to Watch

11. aiTrendview.com Disclosure & Important Notice

About: aiTrendview.com is an independent educational and analytical platform offering AI-curated financial insights for investors and learners.

Purpose: This report is intended solely for training and informational use. It is not a research analyst recommendation, investment advice, or SEBI-registered financial opinion.

Data Sources: Analysis derived from public filings, regulatory documents, and verified financial databases as of October 2025, combined with AI summarization and human editorial review.

Conflicts & Independence: aiTrendview.com and its authors hold no known financial interest or equity position in Tata Capital. No compensation or commission has been received for this article.

Forward-Looking Statements: All projections and expectations are subject to market risk. Past performance does not guarantee future returns.

Investor Caution: Always consult a certified financial advisor before investing. Market conditions and individual suitability must be evaluated independently.

Contact: For corrections, clarifications, or conflict disclosures, contact support@aitrendview.com.

Final Verdict (aiTrendview Summary)

✅ Short-Term: Moderately Positive — steady anchor support and credible fundamentals.

💼 Long-Term: Strong Buy for stability-oriented investors — robust capital, digital transformation, and Tata Group stewardship make this one of the most solid NBFC listings in recent memory.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.