Sudeep Pharma Limited IPO comprises a fresh issue of 16,02,023 equity shares (₹95 crore) and an offer for sale of 1,34,90,726 shares (₹800 crore), totalling ₹895 crore at ₹593 per share (upper price band), with a lot size of 25 shares (minimum ₹14,825). The IPO opened November 21, 2025, closed November 25, allotment finalized November 26, shares credited November 27, and listing scheduled for November 28 on BSE and NSE.

IPO Structure

Pre-issue paid-up equity stands at 11,13,46,602 shares, expanding to 11,29,48,625 post-issue. Promoter holding decreases from 89.37% (9,95,03,523 shares by Sujit Jaysukh Bhayani, Avani Sujit Bhayani, Shanil Sujit Bhayani, Sujeet Jaysukh Bhayani HUF, Riva Resources Private Limited, Bhayani Family Trust) to 76.15%. Anchor portion: 45,27,823 shares (₹268.50 crore); QIB: 50%; NII: 15%; Retail: 35%.

Related Parties

Promoters and group entities dominate transactions. Key shareholders (>5%): Riva Resources Private Limited (41.07%), Sujit Jaysukh Bhayani (25.32%), Sujeet Jaysukh Bhayani HUF (14.01%), Nuvama Private Investments Trust (8.93%). Trade payables to related parties: ₹20.40 million (June 2025), ₹21.59 million (March 2025). Subsidiaries include Sudeep Nutrition Private Limited, Sudeep Pharma USA Inc., Sudeep Pharma B.V., Sudeep Advanced Materials Private Limited, and step-down Nutrition Supplies and Services Ireland Limited (acquired May 22, 2025, for ₹1,363.22 million, goodwill ₹686.95 million).

Promoter Loan Terms

Promoters pledged equity shares to Catalyst Trusteeship Limited as security for debentures issued by Riva Resources Private Limited (debenture trust deeds dated June 24, 2024, with Sujit Jaysukh Bhayani, Shanil Sujit Bhayani). No explicit promoter loans detailed; borrowings primarily bank term loans (e.g., Citi Bank USD loans at 2.50-3.25%, Kotak Mahindra at 9.6%) secured by assets, plant, and corporate guarantees, totaling ₹368.83 million non-current (June 2025). Pledged shares may dilute promoter holding if invoked.

Restated Financials

For period ended June 30, 2025: Revenue ₹1,249.18 million, PAT ₹312.70 million (basic/diluted EPS ₹2.80 on 10,99,38,501 shares), net worth ₹6,883.21 million, total borrowings ₹1,359.72 million. FY2025: Revenue ₹5,019.99 million (up 9.3% YoY), PAT ₹1,386.91 million (EPS ₹12.78), EBITDA ₹1,992.81 million (39.7% margin), RoNW 27.88%. Trade receivables ₹1,875.88 million; ageing shows ₹260.03 million (1-2 years).

Monitoring Agency & Use of Proceeds

No explicit monitoring agency named in RHP excerpts; standard SEBI requirements apply for issues >₹100 crore. Fresh issue proceeds (₹95 crore): ₹75.81 crore for machinery at Nandesari Facility I, ₹12.67 crore general corporate purposes (≤25% of gross proceeds). OFS proceeds to selling shareholders (promoters)

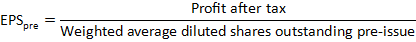

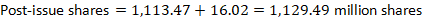

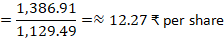

Post-Issue EPS & Implied P/E

Pre-issue diluted EPS (FY2025): ₹12.46 (1,113.47 million shares). Post-issue share capital: 1,129.49 million; assuming full dilution and EPS dilution by fresh issue ratio (~1.43%), post-issue diluted EPS ≈ ₹12.46 × (1,113.47 / 1,129.49) ≈ ₹12.27. At ₹593 upper band, market cap ≈ ₹6,700 crore, implied P/E ≈ 53.55x FY2025 post-issue.

To show the calculation steps and assumptions for post-issue diluted EPS for Sudeep Pharma Ltd. IPO, here is the breakdown based on the data extracted:

Known Data:

Stepwise Calculation:

12.46 – 12.27 = 0.19 \,₹ \text{ (about 1.5% dilution)}

Assumptions:

Summary:

This calculation follows typical IFRS/Ind AS standards for diluted EPS and includes CCPS conversions fully, consistent with IPO disclosures and restated accounts.

Sudeep Pharma Limited is a technology-driven manufacturer specializing in excipients and specialty ingredients primarily for the pharmaceutical, food, and nutrition sectors. Founded in 1989 and headquartered in Vadodara, Gujarat, India, it produces over 100 products using proprietary processes like encapsulation, spray drying, granulation, trituration, and liposomal preparations. The company has a strong research and development focus with two R&D centers, driving innovations in particle engineering, product shelf-life extension, and nutrient bioavailability enhancement. Sudeep Pharma serves global markets, including the US, Europe, Asia-Pacific, and South America, with a distinguished global customer base including Fortune 500 companies.

The pharmaceutical excipients industry, where Sudeep Pharma operates, is expected to grow significantly, driven by rising demand for generic drugs, innovative drug formulations, personalized medicine, biologics, and biosimilars. Excipients play a critical role in drug stability, bioavailability, and patient-centric formulations such as controlled release and taste-masking. Regulatory pressures for high-purity, safe, and sustainable excipients are boosting the adoption of advanced excipients. India, being one of the leading global producers of generics, has a naturally high demand for excipients and benefits from cost-effective production, though much of the advanced excipient supply still comes from US and Europe. The global pharmaceutical excipients market is forecasted to grow at a CAGR of around 6-8% to exceed $14 billion by 2030.

In addition to pharmaceuticals, Sudeep Pharma serves specialty food and nutrition markets, which are growing due to increased health awareness and demand for plant-based, clean-label, and functional ingredients. The specialty food ingredients market in India is expected to reach about $8.3 billion by 2033, driven by urbanization, rising incomes, and demand for nutritionally enhanced foods including infant and dietary nutrition.

Sudeep Pharma’s competitive strengths include its:

Sudeep Pharma Limited, incorporated in 1989 and headquartered in Vadodara, Gujarat, India, manufactures pharmaceutical excipients, specialty food, and nutritional ingredients using proprietary technologies like encapsulation and spray drying across four facilities with 65,579 MT annual capacity as of June 30, 2025. The company serves over 1,100 customers in 100+ countries, focusing on mineral-based products like iron phosphate for infant nutrition, with subsidiaries including Sudeep Nutrition Private Limited, Sudeep Pharma USA Inc., and Nutrition Supplies and Services Ireland Limited (acquired May 2025). Promoters hold 89.37% pre-IPO, including Riva Resources Private Limited (41.07%).

Key Financial Metrics

| Metric | Q1 FY26 (Jun 2025) | FY25 (Mar 2025) | FY24 | FY23 |

| Revenue from Operations (₹ Mn) | 1,249 | 5,020 | 4,593 | 4,287 |

| PAT (₹ Mn) | 309 | 1,387 | 1,332 | 623 |

| EBITDA (₹ Mn, 39.7% margin FY25) | N/A | 1,993 | N/A | N/A |

| Diluted EPS (₹) | 2.80 | 12.78 | 12.28 | 5.74 |

| RoNW (%) | N/A | 27.88 | N/A | N/A |

Balance Sheet Highlights (₹ Mn)

Post-IPO (upper band ₹593), market cap ≈ ₹6,700 crore, implied FY25 P/E 53.6x on post-issue EPS ₹12.27. Growth driven by 9.3% YoY revenue rise FY25, global nutrition demand, and capacity expansions.

Sudeep Pharma Limited IPO is considered fundamentally strong due to its leadership in the pharmaceutical excipients and specialty ingredients market, high profitability with FY25 EBITDA margins near 40%, PAT margin around 27.6%, and robust Return on Net Worth of 27.88%.

Technical & Valuation Analysis:

Investment Considerations:

| Company/Metric | Sudeep Pharma IPO (Post-Issue) | Peers (Industry Range) |

| Market Cap (₹ Cr.) | ~6,700 | Varies (mid-large caps) |

| P/E Ratio (FY25) | 45-53x (around 53.55x widely cited) | 25-40x typical for nutraceuticals and specialty ingredient players |

| EV/EBITDA | ~34x to 36x (estimates vary 34-40x) | 16-21x typical for peers |

| EV/Sales | ~53x (reported in some broker notes) | 13-16x industry multiple range |

Most Comparable to Sudeep Pharma by Revenue Mix

Fine Organics and Anupam Rasayan India emerge as the most comparable listed peers to Sudeep Pharma by revenue mix, given their significant exposure to specialty ingredients for pharma, food, and nutrition sectors alongside chemicals.arihantplus+2

Revenue Mix Comparison

| Company | Pharma/Nutrition | Food/Specialty Additives | Other (Chemicals/Performance) | Total Revenue (Recent FY, ₹ Cr) |

| Sudeep Pharma | ~60-70% (excipients, vitamins/minerals for pharma & nutrition) | ~20-30% (food ingredients) | Minimal | 502 (FY25) |

| Fine Organics | Significant (pharma intermediates) | 28-30% (food additives) | 70% plastics/performance chemicals | 2,205 (FY24) |

| Anupam Rasayan | 23% (life sciences/pharma) | Limited | 61% (performance materials/agrochem) | 1,101 (Recent) |

| Neogen Chemicals | 65-83% (pharma intermediates) | Negligible | Lithium/bromine chemicals (17-35%) | ~800+ (Recent) |

Fine Organics aligns closest with Sudeep’s diversified pharma-food-nutrition split (pharma excipients akin to Fine’s pharma additives, both leveraging specialty formulations). Anupam Rasayan matches on pharma-heavy life sciences but leans more toward performance chemicals. Neogen is pharma-dominant but lacks food/nutrition exposure.valuepickr+3

Sudeep’s niche (excipients/specialty minerals) lacks exact Indian listed matches, positioning it as a premium play versus these peers’ broader chemical portfolios.

Conclusion:

The IPO fits investors seeking exposure to a niche, high-margin pharmaceutical ingredient company with a strong growth outlook but requires patience due to premium initial pricing. Aggressive valuation advises against expecting significant short-term listing returns, favouring long-term investment to realize value from growth and margin expansion.

Investors should also monitor the stock’s technical momentum post-listing for entry timing, balancing fundamentals with market price action signals.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.