Shlokka Dyes Limited IPO Analysis incorporating the latest bidding data, subscription status, lot details, issue size, and promoter holding as of October 4, 2025.

Shlokka Dyes Limited IPO – Complete Investor Report & Valuation Outlook (aiTrendview.com)

Company Overview

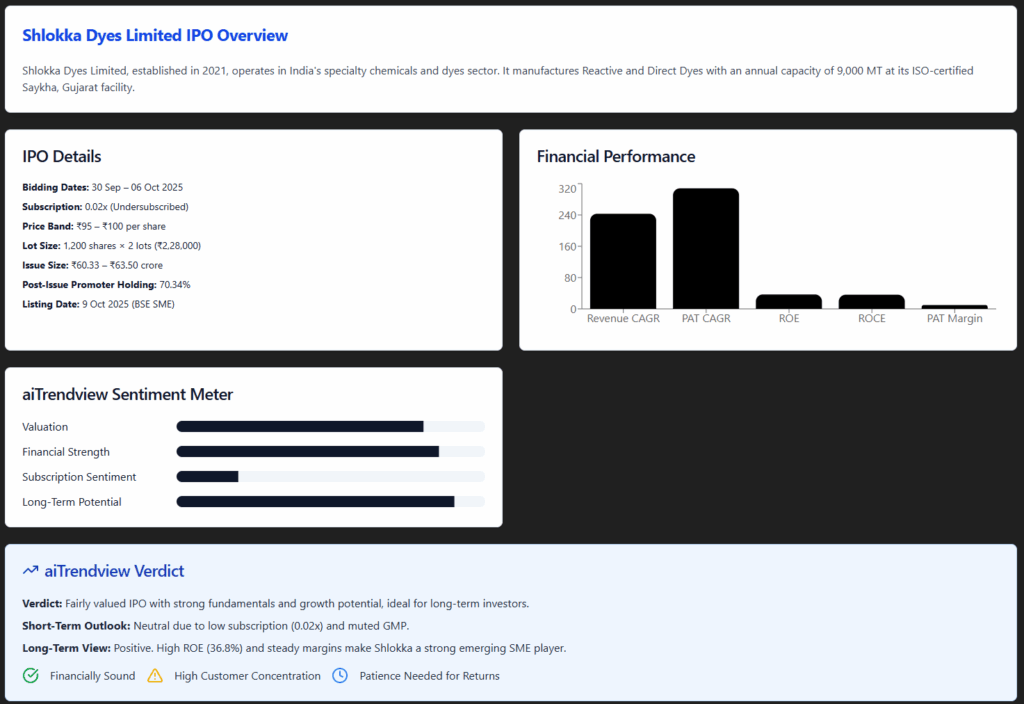

Founded in July 2021, Shlokka Dyes Limited is a fast-emerging manufacturer in India’s specialty chemical and dyes sector. The company’s core product line includes Reactive Dyes, Direct Dyes, Vat Dyes, Basic Dyes, Digital Printing Dyes, and Paper Dyes, catering to industries such as textiles, leather, paper, and paints.

Its state-of-the-art manufacturing plant at Saykha, Gujarat, has a total installed capacity of 9,000 MT per annum and is certified with ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018.

The business is managed by Mr. Vaibhav Shah (Managing Director) and Ms. Shivani Rajpurohit (Director), both having extensive experience in the dyes and intermediates industry.

Industry Context

India’s chemical and dyes industry, valued at over $220 billion, is on track to reach $300 billion by 2030, driven by exports, government incentives, and the expansion of the textile and industrial coatings sectors.

India currently commands nearly 15% of the global dyes market, and with the textile industry projected to hit $350 billion by 2030, companies like Shlokka Dyes Limited stand to benefit from long-term demand momentum.

Key Financial Ratios and Growth Trends

1. Revenue & Profit Growth

| Year | Revenue (₹ Cr) | PAT (₹ Cr) |

| FY23 | 8.8 | 0.6 |

| FY24 | 61.3 | 4.9 |

| FY25 | 103.2 | 10.0 |

Highlights:

2. Profitability & Margins

| Year | EBITDA Margin (%) | PAT Margin (%) | ROE (%) | ROCE (%) |

| FY23 | 18.25 | 6.83 | 6.99 | 6.71 |

| FY24 | 20.76 | 7.97 | 27.99 | 25.46 |

| FY25 | 18.05 | 9.68 | 36.82 | 36.14 |

✅ EBITDA margins remain healthy between 18–21%.

✅ PAT margin improved steadily to 9.68%.

✅ ROE and ROCE indicate exceptional capital utilization.

3. Liquidity & Leverage

| Year | Current Ratio | Debt/Equity | NAV/Share (₹) |

| FY23 | 0.80 | 2.27 | 4.01 |

| FY24 | 1.18 | 1.63 | 6.49 |

| FY25 | 1.34 | 1.02 | 18.06 |

✅ Current Ratio improving consistently.

✅ Debt-to-Equity has dropped from 2.27 to 1.02, showing a stronger balance sheet.

✅ NAV/Share increased substantially due to expansion and retained earnings.

Valuation Snapshot

| Metric | Value |

| Post-IPO Market Cap | ₹126 – ₹133 crore |

| FY25 EPS | ₹6.65 |

| P/E (at ₹100/share) | ~15x |

| Industry P/E Range | 30x – 45x |

| Valuation View | Fairly priced with growth upside |

Peer Comparison (FY25)

| Company | PAT Margin (%) | ROE (%) | P/E (x) |

| Shlokka Dyes Ltd | 9.68 | 36.82 | 15.0–21.4 |

| Deepak Chemtex | 14.81 | 18.81 | 14.77 |

| Vipul Organics | 2.73 | 7.24 | 75.65 |

| Ishan Dyes & Chemicals | 1.04 | 1.06 | 115.87 |

Interpretation:

Shlokka Dyes outperforms peers in ROE and profitability while maintaining a moderate P/E, offering a blend of growth and reasonable valuation.

IPO Details & Present Status (as of 4 October 2025)

| Particulars | Details |

| Bidding Dates | 30 September – 6 October 2025 |

| Subscription Status | 0.02x (Undersubscribed) |

| Minimum Investment | ₹2,28,000 |

| Minimum Lot | 2 |

| Maximum Lot | 2 |

| Lot Size | 1,200 shares per lot |

| Total Shares Offered | 6.4 million (64 lakh shares) |

| Issue Price Band | ₹95 – ₹100 per share |

| Post-Issue Promoter Holding | 70.34% |

| Issue Size | ₹60.33 – ₹63.50 crore |

| Market Segment | BSE SME |

| Allotment Date | 7 October 2025 |

| Listing Date | 9 October 2025 |

aiTrendview Observation:

The IPO remains largely undersubscribed with limited retail and HNI participation so far. The high minimum investment (₹2.28 lakh) and low liquidity typical of SME issues may have affected early response. However, long-term investors could find value in the company’s strong growth trajectory and improving financial profile.

Use of IPO Proceeds

Strengths

✅ Strong Financial Momentum: Explosive revenue and profit CAGR.

✅ High Return Ratios: ROE and ROCE above 35%.

✅ Improving Balance Sheet: Lower leverage, higher liquidity.

✅ Strategic Gujarat Location: Advantage in raw material sourcing and exports.

✅ ISO Certified Operations: Quality, safety, and environmental compliance.

Risks

⚠️ Customer Concentration: 99% of revenue from top 10 clients.

⚠️ SME Liquidity Risk: Lower trading volumes post-listing.

⚠️ Raw Material Volatility: Chemical prices fluctuate with global markets.

⚠️ Environmental Regulation: Potential compliance cost increases.

Eligibility & Application Requirements

| Criteria | Details |

| Investor Type | Retail & HNI (no QIB quota) |

| Demat Account | Mandatory (NSDL/CDSL) |

| Application Process | ASBA/UPI via net banking or broker platform |

| Minimum Investment | ₹2,28,000 (2 lots of 1,200 shares each) |

| Documents Required | PAN, Aadhaar, Demat & Bank account details |

| Mode of Payment | UPI mandate or ASBA block |

aiTrendview Valuation Verdict

| Parameter | Verdict |

| Valuation | Fair, based on growth and earnings |

| Financials | Strong expansion, stable margins |

| Balance Sheet | Improved with low debt |

| Subscription | Weak (0.02x, undersubscribed) |

| GMP (Grey Market Premium) | Flat / Neutral |

| Listing Sentiment | Cautious short term |

| Long-term View | Positive for patient investors |

aiTrendview Takeaway

Shlokka Dyes Limited offers a solid long-term play in India’s growing specialty chemicals and dyes market, combining:

While short-term listing gains may be muted due to low subscription, the financial fundamentals and industry positioning suggest potential long-term wealth creation for committed investors.

Disclaimer

This report is prepared by aiTrendview.com for educational and informational purposes only. It does not constitute trading, investment, or financial advice. aiTrendview.com and its contributors are not SEBI-registered analysts.

Data has been extracted from the company’s official RHP and public disclosures using AI-assisted financial interpretation. Investors are strongly advised to consult certified advisors before making any investment decisions.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.