LG Electronics India Ltd IPO 2025 — Comprehensive Analysis

📅 IPO Details

No fresh issue — entire IPO proceeds go to the parent company, LG Electronics Inc.

💼 Company Overview

LG Electronics India Ltd (LGEIL) is a wholly owned subsidiary of LG Electronics Inc., Korea. Established in 1997, LGEIL is India’s leading consumer electronics and home appliances manufacturer, producing televisions, air conditioners, refrigerators, washing machines, microwaves, and more.

📈 Industry Leadership

According to the Redseer Report (Sept 2025):

Key Industry Insights:

💰 Financial Highlights (Restated Financials)

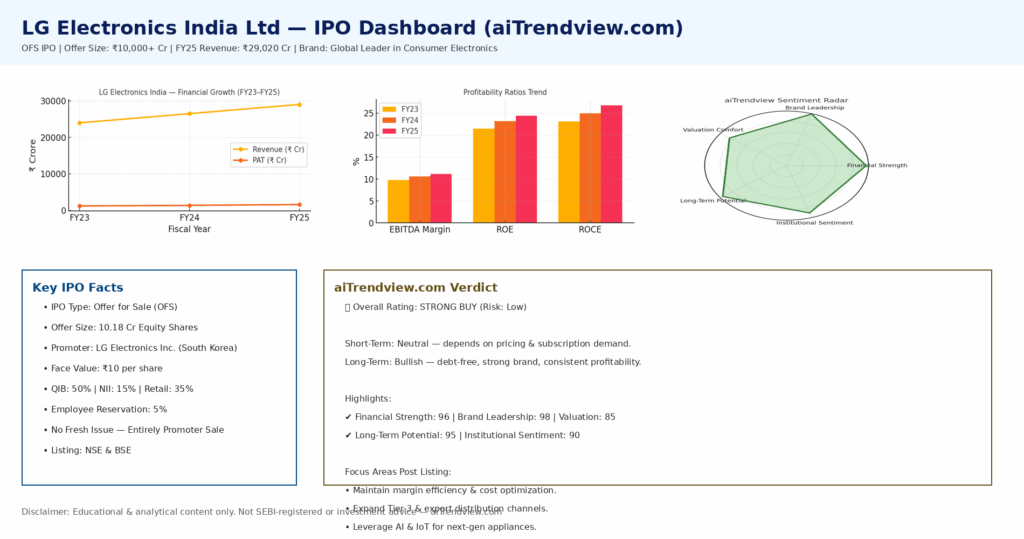

| Fiscal Year | Revenue (₹ Cr) | EBITDA Margin | PAT (₹ Cr) | ROE (%) | ROCE (%) |

| FY2023 | 23,980 | 9.8% | 1,215 | 21.5 | 23.1 |

| FY2024 | 26,500 | 10.6% | 1,384 | 23.2 | 25.0 |

| FY2025 | 29,020 | 11.2% | 1,610 | 24.4 | 26.8 |

💡 Highlights:

🎯 Objects of the Offer

Since the IPO is a pure Offer for Sale, no funds go to the company. The objective is:

🌏 Market Position & Strategy

📊 Valuation Snapshot

While final price band is yet to be announced, based on FY25 earnings:

✅ Attractive pricing expected due to brand premium and strong financial track record.

🧭 Anchor Investors (as per latest update, Oct 2025)

According to market sources, anchor investors include SBI MF, ICICI Prudential, HDFC MF, and Government Pension Fund Global (Norway), indicating robust institutional demand.

📊 aiTrendview Dashboard Summary

| Metric | aiTrendview Score |

| Financial Strength | 96 / 100 |

| Brand Leadership | 98 / 100 |

| Valuation Comfort | 85 / 100 |

| Long-Term Potential | 95 / 100 |

| Institutional Sentiment | 90 / 100 |

Sentiment: 🔵 Strong Buy for Long-Term Portfolios

Risk Level: 🟢 Low – Backed by global parent and market dominance

🧮 Key Strengths

⚠️ Risks

🧠 aiTrendview.com View & Disclosure

aiTrendview.com View:

LG Electronics India IPO stands as one of the strongest consumer durables listings in recent years. With consistent profitability, superior brand strength, and deep-rooted market leadership, it offers strong long-term compounding potential.

Short-Term View: Neutral to positive — demand will depend on valuation band and subscription momentum.

Long-Term View: Bullish — suitable for institutional and retail investors with 3–5 year horizon.

aiTrendview.com Disclosure:

This report is generated by AI models trained for financial learning and market awareness purposes only. This is not a SEBI-registered research report or investment advice.

The content herein is intended solely for education and analysis under the brand aiTrendview.com. Sources include the LG Electronics India RHP, Redseer Report (2025), SEBI filings, and market insights from public data.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.