Greenleaf Envirotech Limited IPO (October 2025 Edition) — structured, detailed, and professionally formatted like the Shlokka Dyes Limited blog, with valuation analysis, financials, subscription tracker, and disclaimer.

Greenleaf Envirotech Limited IPO Analysis – A Complete Investor Report.

Company Overview

Founded in May 2021, Greenleaf Envirotech Limited is a fast-growing player in India’s environmental engineering and wastewater management sector. The company specializes in designing, constructing, and operating effluent and sewage treatment plants (ETP/STP), as well as providing turnkey environmental solutions for industrial, municipal, and residential clients.

Its services include:

The company’s operations are supported by a technically skilled team led by Mr. Kalpesh Gordhanbhai Goti (Managing Director) and Ms. Gopiben Kalpesh Goti (Director). The promoters bring over two decades of experience in environmental technology, water treatment, and EPC contracting.

Industry & Market Context

India’s environmental engineering and wastewater treatment industry is valued at over USD 20 billion, expected to grow at a CAGR of 11–13% through 2030.

Key growth drivers include:

As India becomes more industrialized, wastewater treatment and solid waste management solutions are expected to witness robust expansion, creating favorable tailwinds for companies like Greenleaf Envirotech Limited.

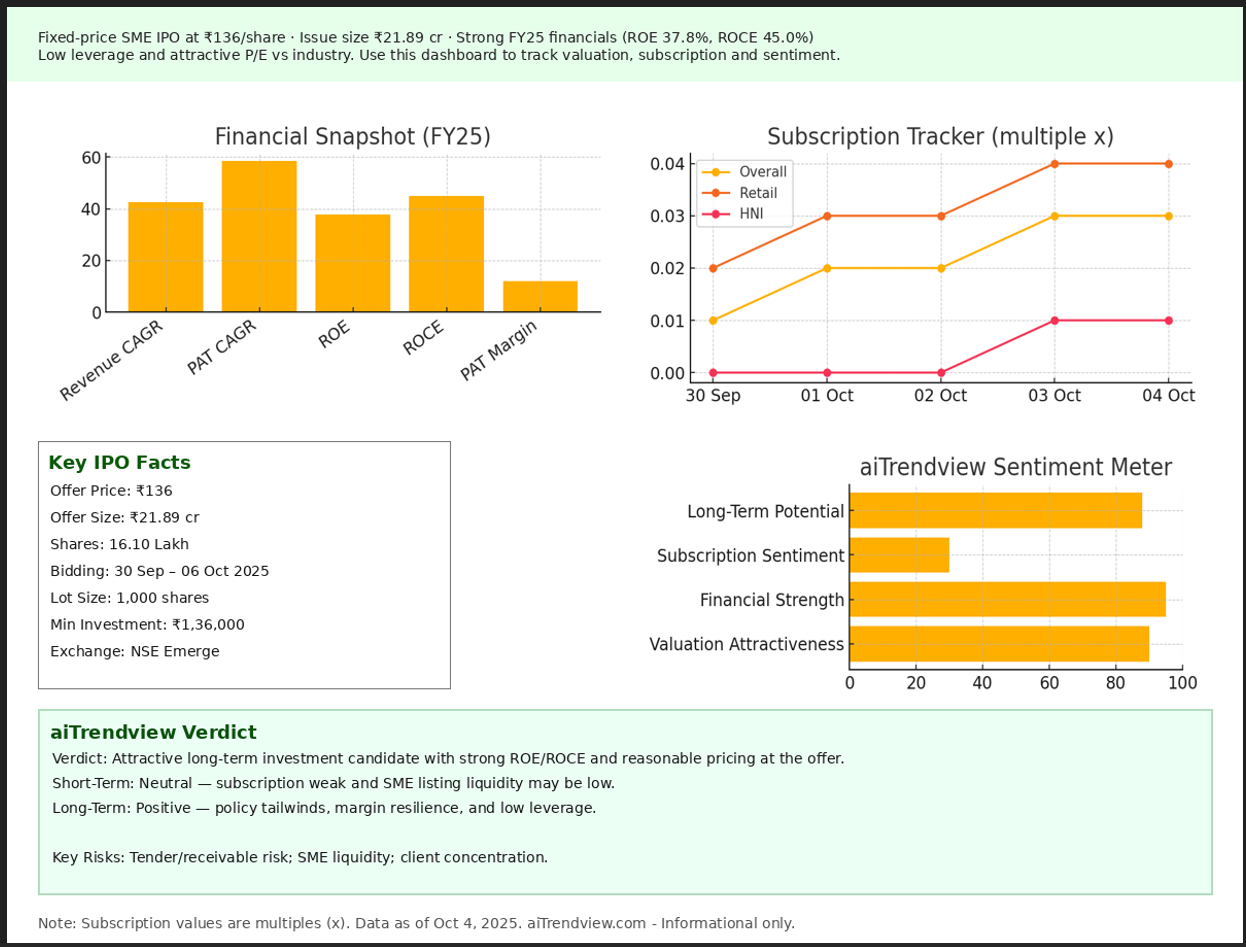

Financial Performance Snapshot (FY23–FY25)

| Year | Revenue (₹ Cr) | PAT (₹ Cr) | EBITDA Margin (%) | PAT Margin (%) | ROE (%) | ROCE (%) | D/E | EPS (₹) | NAV (₹) |

| FY23 | 18.85 | 1.86 | 15.60 | 9.87 | 24.52 | 28.75 | 0.48 | 3.71 | 15.13 |

| FY24 | 27.62 | 2.93 | 17.83 | 10.61 | 31.22 | 36.19 | 0.32 | 6.25 | 17.88 |

| FY25 | 38.45 | 4.65 | 19.11 | 12.09 | 37.84 | 45.01 | 0.20 | 10.17 | 27.30 |

Key Observations:

Peer Comparison (FY25)

| Company | PAT Margin (%) | ROE (%) | P/E (x) | ROCE (%) |

| Greenleaf Envirotech Ltd | 12.09 | 37.84 | 13.37 | 45.01 |

| Felix Industries | 8.42 | 10.18 | 64.74 | 16.12 |

| Apex Ecotech | 10.19 | 18.52 | 20.81 | 21.64 |

| Effwa Infra | 8.75 | 21.20 | 24.34 | 26.32 |

Interpretation:

✅ Greenleaf demonstrates superior returns on capital and equity among peers.

✅ At a P/E of 13.37x, the IPO appears undervalued versus the industry average (36.6x).

IPO Details & Present Status (as of 4 October 2025)

| Particulars | Details |

| IPO Type | Fixed Price Issue |

| Bidding Dates | 30 September – 6 October 2025 |

| Subscription Status | 0.03x (Undersubscribed) |

| Issue Price | ₹136 per share |

| Face Value | ₹10 per share |

| Lot Size | 1,200 shares |

| Minimum Investment | ₹1,63,200 |

| Issue Size | ₹21.89 crore (2,189 lakh) |

| Total Shares Offered | 16.1 lakh shares |

| Post-Issue Promoter Holding | 70.45% |

| Allotment Date | 7 October 2025 |

| Listing Date | 9 October 2025 |

| Exchange | NSE SME |

aiTrendview Observation:

The IPO has seen muted participation so far with overall subscription at 0.03x.

This is typical of early-stage SME IPOs despite strong fundamentals. Market sentiment remains neutral in the short term, though the valuation and growth make it attractive for long-term investors.

Use of IPO Proceeds

Strengths & Competitive Edge

✅ Diversified Service Portfolio – Design, EPC, and O&M services across water, waste, and environmental engineering.

✅ Strong Financial Discipline – High ROE/ROCE and low leverage.

✅ Government-backed Sector – Policy-driven demand through industrial and municipal mandates.

✅ Experienced Promoters – Over 20 years of technical and project execution experience.

✅ Sustainable Growth – Consistent increase in margins and profitability.

Risks & Concerns

⚠️ Client Concentration: High dependency on industrial EPC clients.

⚠️ Tender-based Business: Revenues tied to project pipeline and contract bidding.

⚠️ Working Capital Intensity: Delay in receivables may affect cash flow.

⚠️ SME Listing Liquidity Risk: Lower post-listing volume and investor base.

Valuation Snapshot

| Parameter | Value | View |

| EPS (FY25) | ₹10.17 | |

| P/E (at ₹136) | 13.37x | Attractive vs peers |

| Industry Average P/E | 36.63x | |

| ROE / ROCE | 37.84% / 45.01% | Excellent |

| Debt/Equity | 0.20 | Low leverage |

| Current Ratio | 1.95 | Strong liquidity |

| Valuation Verdict | Fairly priced with growth upside | ✅ |

Eligibility & Application Requirements

| Criteria | Details |

| Investor Category | Retail & HNI (no QIB quota) |

| Demat Account | Mandatory |

| Application Process | ASBA / UPI via net banking or broker platforms |

| Minimum Investment | ₹1,63,200 (1 lot = 1,200 shares) |

| Documents Required | PAN, Aadhaar, Bank, and Demat details |

| Exchange | NSE SME Platform |

aiTrendview Verdict

| Parameter | Status |

| Valuation | Attractive (Low P/E, strong returns) |

| Financial Strength | Excellent |

| Subscription Sentiment | Low (0.03x) |

| Sector Outlook | Positive (Govt-backed, sustainable) |

| Risk Level | Moderate |

| Long-Term View | Strong Buy (for patient investors) |

Investor Takeaway

Greenleaf Envirotech Limited is an emerging environmental engineering company positioned at the intersection of sustainability, infrastructure, and water security.

With robust financials, steady growth, and a fair valuation, the company presents a long-term investment opportunity for those willing to hold through SME volatility.

However, investors must be mindful of working capital risks and lower listing liquidity in the SME segment.

Disclaimer

This report is prepared by aiTrendview.com purely for educational and learning purposes. It does not constitute financial, trading, or investment advice.

aiTrendview.com and its authors are not SEBI-registered analysts.

All data and insights are derived from the company’s official RHP and public disclosures (October 2025), analyzed through AI-assisted financial models.

Investors are advised to consult certified professionals before making investment decisions.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.