Global Market Research Report

Recent global market action was marked by a robust comeback in major equities, with the Dow Jones Industrial Average , S&P 500 , and Russell 2000 all rallying sharply into the weekend. Gains were broad, supported by improved risk sentiment and rising expectations for a potential US rate cut in December, which helped reverse most of the week’s early losses. Commodity markets remained mixed—crude oil and heating oil slid on demand concerns, while metals like gold , silver, and copper found fresh buyers amid a softer dollar. Grains recovered, led by soybeans on export optimism, but softs (notably cocoa and orange juice) pulled back following prior surges.

In the crypto sector, Bitcoin steadied above $84,000 after a week of high volatility tied to ETF outflows and retail selling, while altcoins mostly struggled to recover. Currencies saw the US Dollar tread water as traders weighed upcoming Fed communications and global macro data. Overall, volatility dropped notably in equities and FX, suggesting markets are awaiting further catalysts. The technical tone remains constructive for broad risk assets but fragile for crypto, with sentiment turning more selective as investors digest mixed macro signals and sector rotations.

Looking to Monday’s trade, expect modest opening volatility as participants react to Friday’s equity rebound alongside little in the way of high-impact economic data. Watch for the Dallas Fed’s manufacturing index and ongoing global growth headlines as steerage for session tone. With risk appetite newly restored but week-ahead macro still uncertain, traders should be alert to potential reversals in sectors that just saw outsized moves, such as US tech, small-caps, and commodities, while continued caution is warranted in crypto until signs of sustained inflow or stabilization emerge.

Indices

| Symbol | Price | Change | %Change | Takeaway |

| DJIA | 46377.00 | +552.00 | +1.20% | Dow jumps sharply, fueled by broad-based rally in blue-chips. Optimism returns to US large-caps as risk appetite improves. |

| S&P 500 | 6631.50 | +74.00 | +1.13% | S&P 500 snaps higher with tech and consumer names in focus. Gains amplified by improved US outlook. |

| NASDAQ 100 | 24349.00 | +217.50 | +0.90% | Nasdaq recovers on tech buying after recent sell-off. Still, volatility remains above average. |

| RUSSELL 2000 | 2378.40 | +67.70 | +2.93% | Small-cap index soars as traders chase domestic growth. Rotation into risk assets picked up pace. |

| NIKKEI 225 | 48735.00 | +230.00 | +0.47% | Nikkei extends winning streak, retailers and exporters leading. $/¥ supports Japanese earnings. |

| EURO STOXX 50 | 5547.00 | -33.00 | -0.59% | Eurozone stocks cool off, with profit-taking seen after previous highs. Mixed sentiment in Europe. |

| DAX | 23259.00 | -98.00 | -0.42% | Germany’s DAX slips, pressured by weak earnings. Industrials and auto lag behind. |

| VIX | 21.50 | -1.37 | -5.98% | Volatility index drops sharply, marking improved risk sentiment. Traders turning less defensive. |

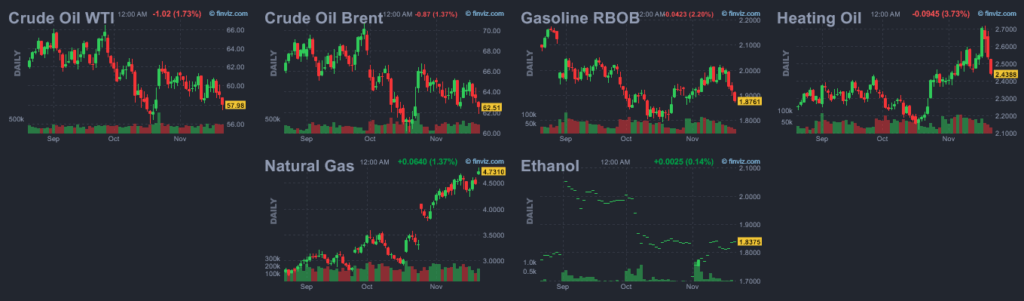

Energy

| Symbol | Price | Change | %Change | Takeaway |

| Crude Oil WTI | 57.98 | -1.02 | -1.73% | Oil prices fall on persistent demand concerns and ample supply. Bulls remain cautious pending OPEC headlines. |

| Brent Crude Oil | 62.51 | -0.87 | -1.37% | Brent mirrors WTI’s drop; weaker global consumption weighs down near-month contracts. |

| Gasoline RBOB | 1.8761 | -0.0419 | -2.20% | Gasoline extends losses as inventory surplus grows. Refinery activity remains robust. |

| Heating Oil | 2.4388 | -0.0945 | -3.73% | Heating oil hit by seasonally warm weather and subdued demand. Bears in control near-term. |

| Natural Gas | 4.7310 | +0.0864 | +1.86% | NatGas sees a short-covering bounce on potential cold front. Volatility remains high. |

| Ethanol | 1.8375 | +0.0025 | +0.14% | Ethanol stable on both solid blending demand and steady corn prices. Biofuels keep up pace. |

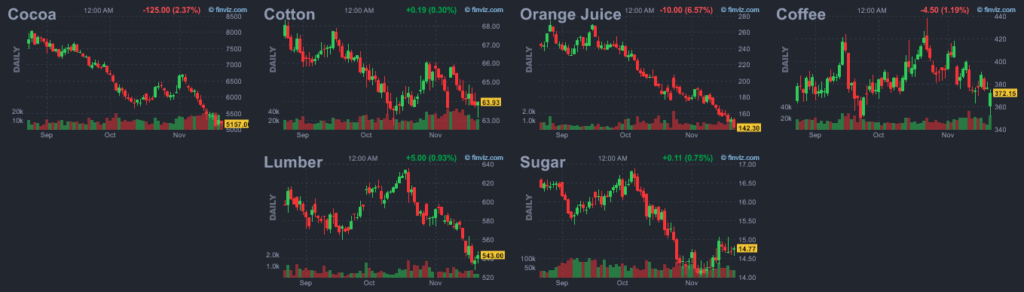

Softs

| Symbol | Price | Change | %Change | Takeaway |

| Cocoa | 5157.00 | -125.00 | -2.37% | Cocoa futures slide despite recent rally; profit booking emerges on export uptick. |

| Cotton | 63.93 | +0.40 | +0.63% | Cotton rallies modestly, supported by export optimism and firm agriculture data. |

| Orange Juice | 142.30 | -10.00 | -6.57% | Orange juice dips on improved crop outlook and easing weather concerns. Volatility high. |

| Coffee | 372.15 | -4.50 | -1.19% | Coffee down as global supply improves. Demand from Asia offers some cushion. |

| Lumber | 543.00 | +5.00 | +0.93% | Lumber prices hold up as US building sector picks up. Bottom-fishing evident. |

| Sugar | 14.77 | +0.11 | +0.75% | Sugar rises on production curbs in Brazil. Bulls encouraged by rising import demand. |

Metals

| Gold | 4062.80 | +7.00 | +0.17% | Gold edges higher as real yields ease. Safe-haven flows provide consistent support. |

| Silver | 49.66 | +0.66 | +1.35% | Silver stages a rebound on industrial demand signals. Volatility back on upside. |

| Platinum | 1523.40 | +4.20 | +0.28% | Platinum finds bids with improving auto sector demand. Bulls cautiously optimistic. |

| Copper | 4.9960 | +0.0275 | +0.55% | Copper climbs with rising China industrial demand. Medium-term trend remains constructive. |

| Palladium | 1384.50 | -0.14 | -0.01% | Palladium stabilizes, auto catalysts sector in focus. Tight range likely ahead. |

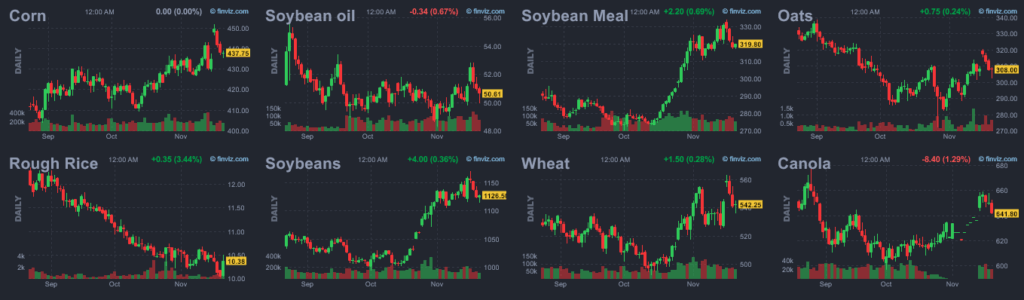

Grains

| Symbol | Price | Change | %Change | Takeaway |

| Soybeans | 1126.50 | +5.25 | +0.47% | Soybeans recover with renewed export demand and US weather concerns. Trend may extend if China books more cargoes. |

| Soybean Meal | 319.80 | +2.20 | +0.69% | Soybean meal higher as livestock sector demand builds. Supply chain issues support prices. |

| Soybean Oil | 50.61 | +0.07 | +0.14% | Soybean oil steady as palm oil rallies alongside. Biofuel narrative remains supportive. |

| Corn | 437.75 | +0.80 | +0.18% | Corn edges up on trade chatter and supply restocking. Bulls tentative pending export data. |

| Wheat | 542.25 | +0.25 | +0.05% | Wheat flat, global stocks keep gains in check. New export deals could change mood. |

| Rough Rice | 10.38 | +0.33 | +3.28% | Rough rice jumps, led by Asian procurement and tighter stocks. Importers active in US market. |

| Oats | 308.00 | +0.75 | +0.24% | Oats modestly stronger as feed demand rises. Weather in Canada closely watched. |

| Canola | 641.80 | -8.40 | -1.29% | Canola plunges on oversupply and weak Canadian auctions. Prices at multi-session low. |

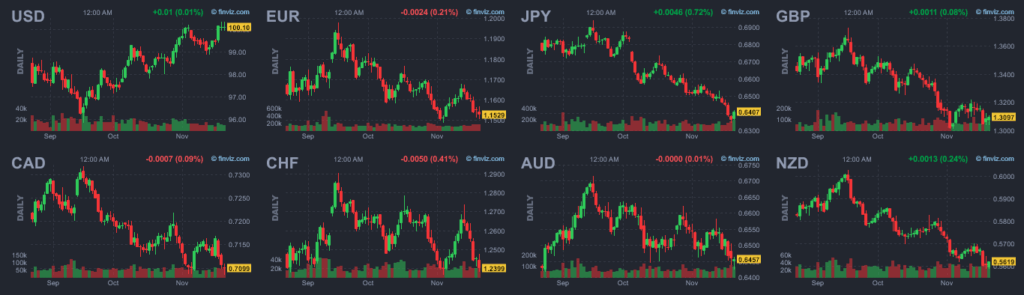

Currencies

| Symbol | Price | Change | %Change | Takeaway |

| USD | 100.10 | +0.01 | +0.01% | Dollar index steady, traders eye Fed and macro data. Sentiment remains cautious. |

| EUR | 1.1529 | -0.0061 | -0.53% | Euro weakens on mixed macro data and US dollar strength, but volatility is subdued. |

| JPY | 0.6407 | +0.0006 | +0.09% | Yen marginally stronger; flows favor traditional safety after recent volatility. |

| GBP | 1.3097 | +0.0007 | +0.05% | GBP stabilizes after rally, traders await UK inflation data. |

| CAD | 0.7099 | -0.0009 | -0.13% | Canadian dollar slips, following oil lower; watching for Bank of Canada cues. |

| CHF | 1.2399 | +0.0031 | +0.25% | Swiss franc holds gains as Europe’s risk mood stays defensive. |

| AUD | 0.6457 | +0.0015 | +0.23% | Aussie dollar grinds up, commodity-linked trading continues to support. |

Cryptocurrencies

| Symbol | Price | Change | %Change | Takeaway |

| BTC/USD | 84211.00 | +65.00 | +0.08% | Bitcoin consolidates at higher levels, volatility declining post-selloff. Bulls cautious but upside attempts persist. |

| ETH/USD | 2741.24 | -3.06 | -0.11% | Ethereum trades flat, tracking Bitcoin’s calm but facing resistance. Market looks for clearer trend confirmation. |

| SOL/USD | 126.17 | -0.67 | -0.53% | Solana slips amid light volume, reflecting broader pause in alts. Technicals suggest sideways price action ahead. |

| BNB/USD | 824.56 | -5.36 | -0.65% | Binance Coin drops, following sector sentiment and softening DeFi use. Bulls defensive for now. |

| XRP/USD | 1.9307 | -0.0033 | -0.17% | XRP little changed after sharp swings; traders waiting for clarity. Bulls stepping in at key support. |

| DOGE/USD | 0.1371 | -0.0004 | -0.27% | Dogecoin stabilizes after heavy selling; meme sentiment muted. Awaiting new catalyst for breakout. |

| ADA/USD | 0.4015 | -0.0021 | -0.52% | Cardano weak, mirroring altcoin market tone. Investors watch for rebound on oversold signals. |

| TRX/USD | 0.2755 | -0.0002 | -0.06% | Tron stays flat, outperforming . Broader rangebound momentum in play. |

| AVAX/USD | 13.27 | +0.02 | +0.15% | Avalanche edges up with DeFi headlines, outperforming weaker alts. Sentiment moderately brighter. |

| XLM/USD | 0.2292 | -0.0009 | -0.40% | Stellar dips, tracking broader crypto flows. Low volatility persists. |

| DOT/USD | 2.2860 | -0.0130 | -0.57% | Polkadot declines as investor risk appetite remains subdued. Eyes on next development milestone. |

| LINK/USD | 11.92 | -0.09 | -0.78% | Chainlink trades lower in sync with DeFi sector. Dev updates may drive sentiment soon. |

| BCH/USD | 526.96 | -4.84 | -0.91% | Bitcoin Cash corrects, mirroring BTC’s lackluster movement. Support levels hold for now. |

| SUI/USD | 1.3582 | -0.0062 | -0.45% | Sui drifts lower with low overall liquidity. Watch for volatility spikes ahead. |

| NEAR/USD | 1.8510 | -0.0190 | -1.02% | NEAR slides after recent highs; trend softens with sector. Buyers yet to step in meaningfully. |

| LTC/USD | 82.32 | -0.15 | -0.18% | Litecoin treads water; technical picture unclear. Major moves likely to mirror BTC lead. |

| APT/USD | 2.3040 | -0.0380 | -1.62% | Aptos underperforms, returning gains after Wednesday’s rally. Bears gaining short-term momentum. |

| EGLD/USD | 9.54 | +0.16 | +1.75% | EGLD rises against the tide, one of few altcoin winners today. Network news underpins optimism. |

| OP/USD | 0.2922 | -0.0035 | -1.18% | Optimism slides, high-beta alts out of favor. Longer-term trend still constructive. |

| AAVE/USD | 157.92 | -0.66 | -0.42% | Aave modestly lower, DeFi volumes lighter. Range likely to persist unless major event emerges. |

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.