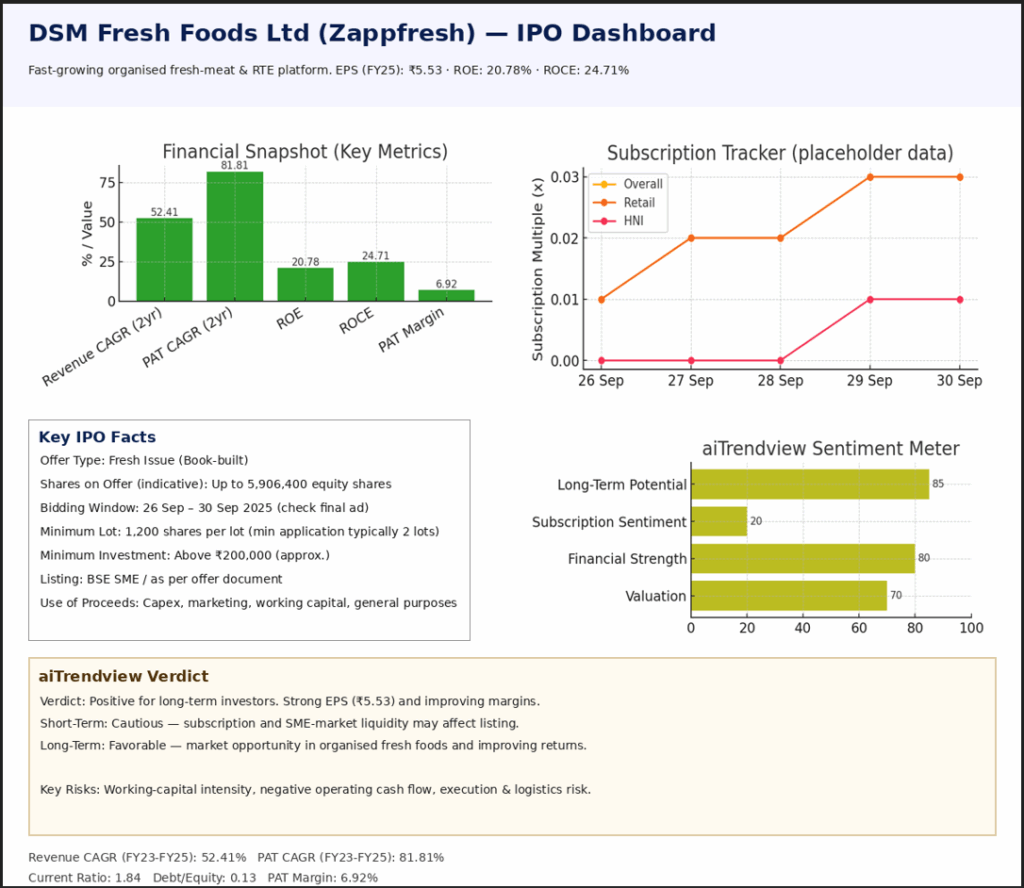

DSM Fresh Foods Limited (Zappfresh) with the same full feature set as the previous reports (company overview, industry context, financials, peer comparison, IPO details & present status, subscription tracker note, valuation, eligibility, checklist, verdict, and disclaimer).

DSM Fresh Foods Limited (Zappfresh) — Full IPO Report & Investor Brief (aiTrendview.com)

1) Company Snapshot

DSM Fresh Foods Limited (brand: Zappfresh) is an organised fresh-meat and ready-to-cook / ready-to-eat foods retailer operating an e-commerce platform and mobile app to sell and deliver fresh meat (mutton, poultry, seafood) and allied products. The company controls the farm-to-door cold chain, emphasises traceability and hygiene, and combines branded packaged products with city-level fulfillment and last-mile delivery. The business was founded in 2015 and later converted to a public company. Promoters and management have a mix of technology, operations and packaged-food experience.

2) Industry & Market Context

The organised packaged meat, poultry and seafood market in India is expanding rapidly due to urbanisation, rising disposable incomes, increasing food-safety awareness, and growing demand for convenience foods. The organised segment is still a small share of the overall market, creating a runway for branded players that own cold-chain logistics and digital distribution. Policy focus on food safety and modern retail, combined with consumer shifts toward convenience, support long-term demand.

3) Financial Performance — Key Numbers (Restated; ₹ Lakhs)

Profit & Loss / KPIs (FY23 – FY25)

| Fiscal | Revenue from Operations | EBITDA | EBITDA Margin | PAT | PAT Margin | EPS (₹) |

| FY23 | 5,628.39 | 340.83 | 6.05% | 273.85 | 4.87% | 2.69 |

| FY24 | 9,043.92 | 957.95 | 11.00% | 466.65 | 5.16% | 4.54 |

| FY25 | 13,073.38 | 1,704.63 | 13.04% | 905.18 | 6.92% | 5.53 |

Balance & Efficiency (selected, FY25)

Trend highlights

4) Peer Comparison (select peers — FY25)

| Company | PAT Margin (%) | ROE (%) | EPS (₹) | Indicative P/E (where available) |

| DSM Fresh Foods Ltd | 6.92 | 20.78 | 5.53 | — |

| Peer A (listed comparator) | 7.34 | 7.34 | 2.67 | ~37x |

| Peer B (larger consumer peer) | 8.23 | 8.23 | 99.80 | ~95x |

| Peer C | 7.71 | 7.71 | 1.20 | ~25x |

Takeaway: DSM shows healthy return metrics (ROE) and improving margins relative to peers, but differs in scale and business mix. Use peer P/E only for directional valuation context.

5) IPO — Structure & Present Status

Offer type: Book-built public offer (Fresh Issue).

Total shares on offer (indicative): Up to 59,06,400 equity shares (fresh issue).

Market maker reservation: A small portion reserved for market maker participation.

Bid / Issue period: Anchor day and bidding window typically in late September – check final issue advertisement for exact dates.

Minimum lot: 1,200 shares per lot; minimum application is typically two lots (so minimum application value will be above ₹2 lakh depending on final price band).

Listing: SME / mainboard listing as per final offer document.

Present subscription: Subscription data is updated live during the bidding window. Subscription and allotment status will determine short-term listing sentiment.

Important operational note: The company intends to use proceeds for capacity expansion, marketing, working capital, and general corporate purposes. Final allocation and allotment procedures follow SEBI and exchange rules.

6) Use of Proceeds

Planned deployment of net proceeds typically includes:

7) Strengths & Competitive Edge

8) Risks & Concerns

9) Valuation Snapshot & How to Read It

Key numbers (FY25)

Valuation considerations

10) Eligibility & How to Apply

Who can apply: Retail investors, HNIs and institutional applicants as per the offer structure.

Requirements to apply:

11) aiTrendview Verdict & Investor Guidance

Short summary

Recommendation

Investment style match

12) Quick Investor Checklist (before applying)

13) Disclaimer

This report is prepared by aiTrendview.com for educational and informational purposes only and does not constitute investment, legal or tax advice. The content summarizes company filings and public offer details for convenience; investors should conduct their own due diligence and consult a SEBI-registered investment advisor before acting. Market conditions and subscription dynamics at the time of bidding determine allocation and short-term listing outcomes.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.