Global Crude Oil Market Outlook – November 2025

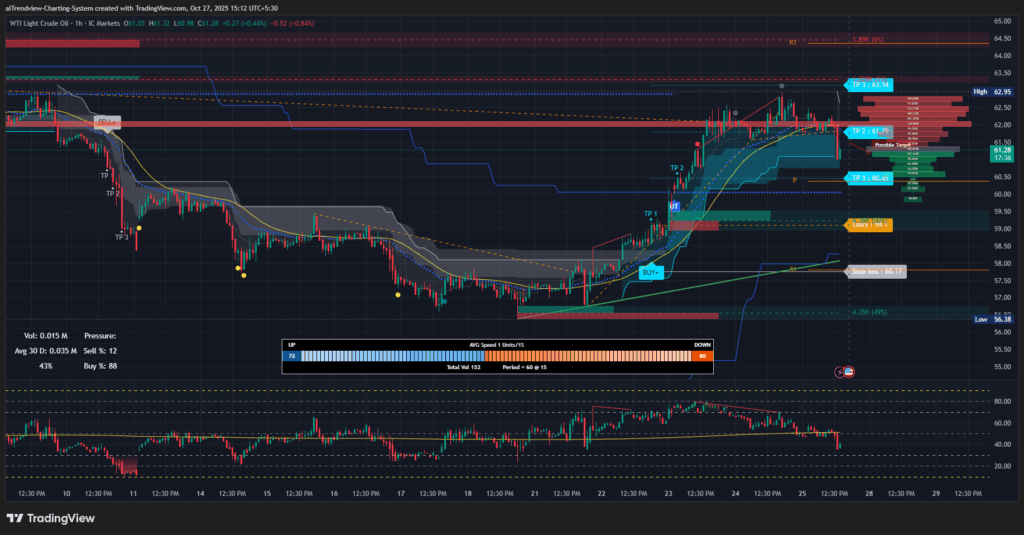

Technical Analysis (WTI & Brent)

Fundamental Analysis

Top Oil Producers and Consumers

| Rank | Top 10 Producers (2023) | Production (mb/d) | Reserves (billion bbl) |

| 1 | United States | 21.9 | 45 |

| 2 | Saudi Arabia | 11.1 | 267 |

| 3 | Russia | 10.8 | 80 |

| 4 | Canada | 5.8 | 4.3 |

| 5 | China | 5.3 | 28.2 |

| 6 | Iraq | 4.4 | 145 |

| 7 | Brazil | 4.3 | 15.9 |

| 8 | United Arab Emirates | 4.2 | 113 |

| 9 | Iran | 4.0 | 208.6 |

| 10 | Kuwait | 2.9 | 101.5 |

| Rank | Top 10 Consumers (2022) | Consumption (mb/d) |

| 1 | United States | 20.0 |

| 2 | China | 15.2 |

| 3 | India | 5.0 |

| 4 | Russia | 3.7 |

| 5 | Saudi Arabia | 3.7 |

| 6 | Japan | 3.4 |

| 7 | Brazil | 3.0 |

| 8 | South Korea | 2.6 |

| 9 | Canada | 2.4 |

| 10 | Germany | 2.2 |

(Production and consumption figures are rounded estimates based on the latest available data.)

November 2025 Price Forecast

Disclaimer

This report is provided for informational and educational purposes only. It is not investment advice, and readers should exercise independent judgment before making any trading or investment decisions. Oil market conditions can change rapidly due to unforeseen events; the analysis above reflects current information and should not be construed as a recommendation.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.